Monthly Market Summary

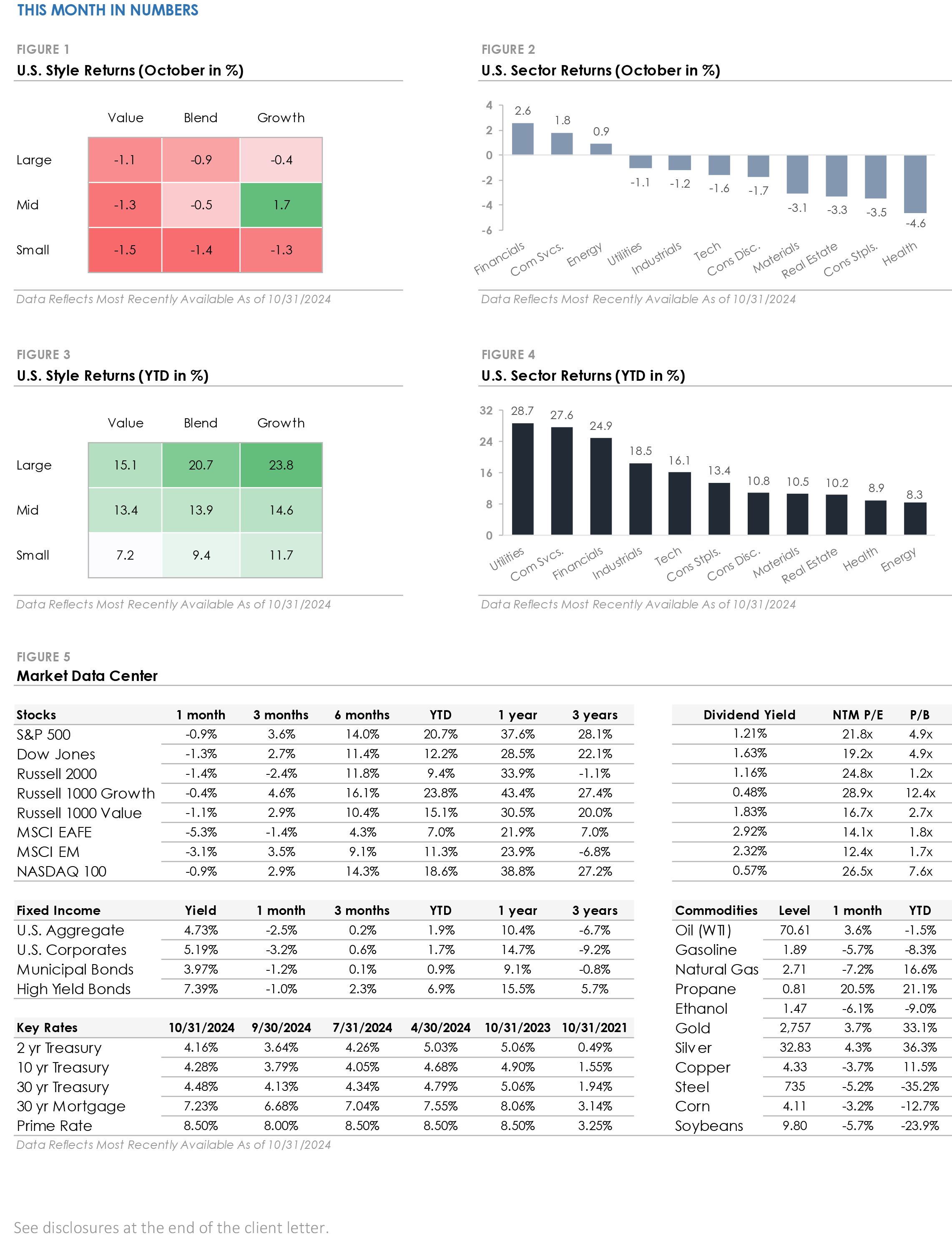

The S&P 500 Index returned -0.9%, outperforming the Russell 2000 Index’s -1.4% return. Three of the eleven S&P 500 sectors traded higher, with Financials and Communication Services both gaining more than +1.5%. The remaining eight sectors all traded lower by more than -1% during the month.

The S&P 500 Index returned -0.9%, outperforming the Russell 2000 Index’s -1.4% return. Three of the eleven S&P 500 sectors traded higher, with Financials and Communication Services both gaining more than +1.5%. The remaining eight sectors all traded lower by more than -1% during the month.

Corporate investment-grade bonds produced a -3.2% total return as Treasury yields rose, underperforming corporate high-yield’s -1.0% total return.

Corporate investment-grade bonds produced a -3.2% total return as Treasury yields rose, underperforming corporate high-yield’s -1.0% total return.

International stocks traded lower. The MSCI EAFE developed market stock index returned -5.3%, while the MSCI Emerging Market Index returned -3.1%.

International stocks traded lower. The MSCI EAFE developed market stock index returned -5.3%, while the MSCI Emerging Market Index returned -3.1%.

Stocks End 5-Month Winning Streak with First Loss Since April

Stocks finished October lower as investors navigated Q3 earnings, the upcoming election, and uncertain Federal Reserve policy. The S&P 500 posted its first monthly loss since April, lowering its year-to-date return to +20.7%. Large-cap stocks slightly outperformed small-cap stocks, but most investment factors produced similar returns. In the bond market, Treasury yields climbed as investors considered the possibility that the Fed may not cut interest rates as much as previously expected. Concerns about fiscal spending also drove Treasury yields higher, with expectations for continued high government spending regardless of the election outcome. With yields rising sharply, bonds traded lower for the first time in six months.

Treasury Yields Spike After the Fed’s September Rate Cut

The bond market has experienced several large swings this year. The 10-year Treasury yield began the year around 3.90%. However, as inflation rose early in the year, the 10-year yield climbed to 4.70% by late April. Yields then reversed over the summer as falling inflation and rising unemployment fueled expectations for deeper rate cuts. Between late April and mid-September, the 10-year yield dropped by over -1.00%. It hit a low of 3.62% the week of the Fed’s September meeting, when the central bank cut interest rates by -0.50%. It may seem counterintuitive, but since the Fed’s September meeting, Treasury yields have risen sharply. The 10-year Treasury yield ended October at 4.28%, rising by over +0.65% in one and a half months.

What’s behind this year’s bond market swings? Volatile economic trends and uncertain Fed policy. Two key data points have increased volatility: inflation surged early in the year before easing over the summer, while unemployment rose from 3.7% in January to 4.3% in July, then fell to 4.1% in September. The Fed aims for stable prices and full employment, but conflicting data has complicated its interest rate decisions. There’s general agreement that the Fed should continue to lower interest rates, but there’s debate about how quickly and how much. The recent increase in Treasury yields reflects expectations for fewer interest rate cuts. As we’ve seen this year, that outlook could change in the coming months.

The S&P 500 Index returned -0.9%, outperforming the Russell 2000 Index’s -1.4% return. Three of the eleven S&P 500 sectors traded higher, with Financials and Communication Services both gaining more than +1.5%. The remaining eight sectors all traded lower by more than -1% during the month.

The S&P 500 Index returned -0.9%, outperforming the Russell 2000 Index’s -1.4% return. Three of the eleven S&P 500 sectors traded higher, with Financials and Communication Services both gaining more than +1.5%. The remaining eight sectors all traded lower by more than -1% during the month.